Fighting Financial Crime: All that Matters

What is financial crime?

Financial Crimes are criminal activities carried out by individuals or criminal organizations to provide economic benefits through illegal methods. Financial crimes, which have become a critical issue in recent years worldwide, cause significant harm to the economy and society.

The most common crimes facing the financial sector are money laundering, terrorist financing, fraud, tax evasion. These crimes are committed every day, and governments worldwide are frequently prosecuting financial criminals while searching for new ones.

Let’s talk about money laundering.

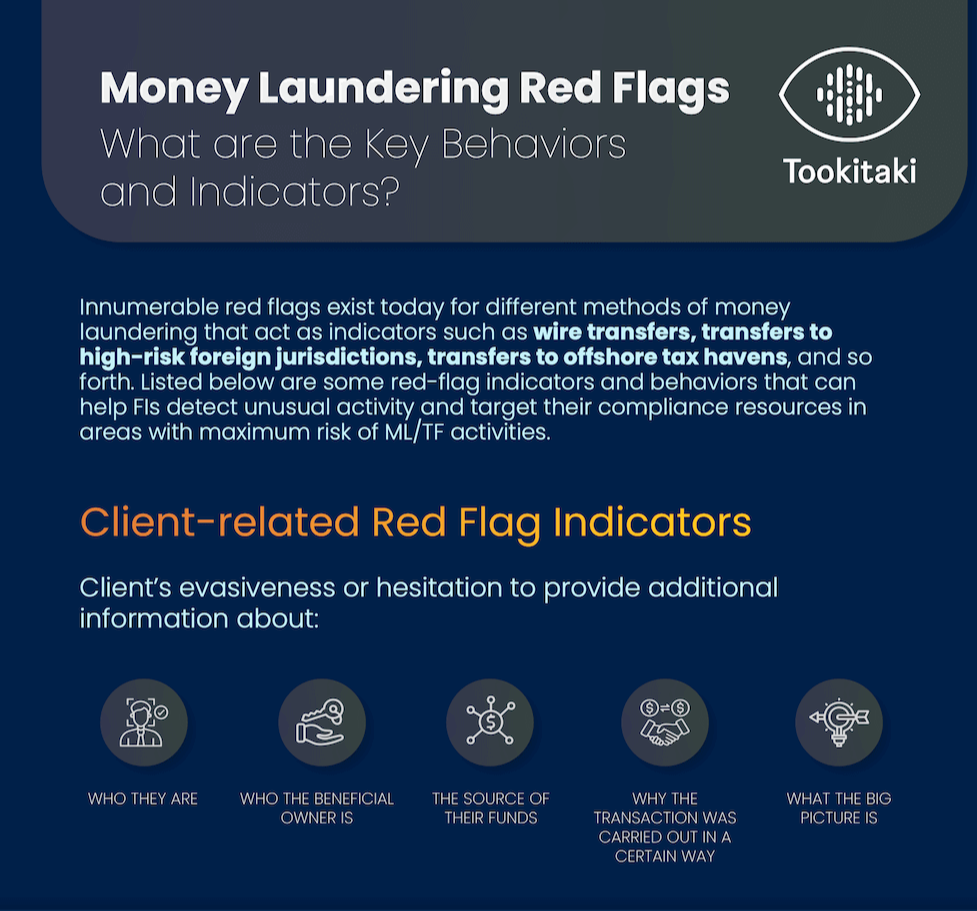

What are some of the red flags?

Innumerable red flags exist today for different methods of money laundering that act as indicators, such as wire transfers, transfers to high-risk foreign jurisdictions, transfers to offshore tax havens, and so forth.

Download the infographic to learn more about red-flag indicators and behaviours that can help financial institutions detect unusual activity and target their compliance resources in areas with maximum risk of money laundering and terrorist financing activities.

Anti-Money Laundering (AML): A Guide for Banks and Fintechs

Are you a bank or fintech company banks and fintech companies trying to stay updated with the ever-changing regulations?

Anti-money laundering (AML) regulations are measures and procedures to detect and prevent money laundering, thereby making it difficult for financial criminals to hide their illegal origin. Money laundering has potentially devastating socio-economic effects as laundered money can be used to gain control of large sectors of the economy through investment. It can also transfer economic power to criminals.

Download the e-book to learn about the key concepts and terms in AML compliance. Understand how you can ensure compliance at a time when regulators change regulations and criminals use sophisticated financial crime strategies to evade detection.

.png)

Customer Due Diligence (CDD) for Banks and Fintech Firms

What is CDD and why is it important?

CDD is the process of collecting and verifying information about a customer during onboarding. CDD helps businesses protect themselves from fraud, money laundering, and other illegal activities. By knowing their customers and analysing information about them obtained from a variety of sources, businesses can avoid doing any business with high-risk individuals or groups. CDD programmes are necessary for financial institutions to mitigate risk and CDD checks will help prevent them from doing business with risky customers.

Download the guide to learn more about how financial institutions can build effective CDD programmes and the role technology plays in enhancing the CDD process.

Suspicious Activity Report (SAR): What You Need to Know

Financial institutions must be aware of when and how to report suspicious activity for the specific country they are operating in and should ensure that their Anti-Money Laundering (AML) process is set up to submit such reports efficiently.

For most countries, this takes the form of a document submitted by a financial institution to the appropriate authority, according to compliance regulations for that country. Documents filed are known as suspicious activity reports (SAR), or sometimes suspicious transaction reports (STR).

Learn more about what constitutes a suspicious activity, who is required to file a SAR and the SAR decision-making process.

.png)

Increasing reliance on technology to fight financial crime

Staying five steps ahead of bad actors

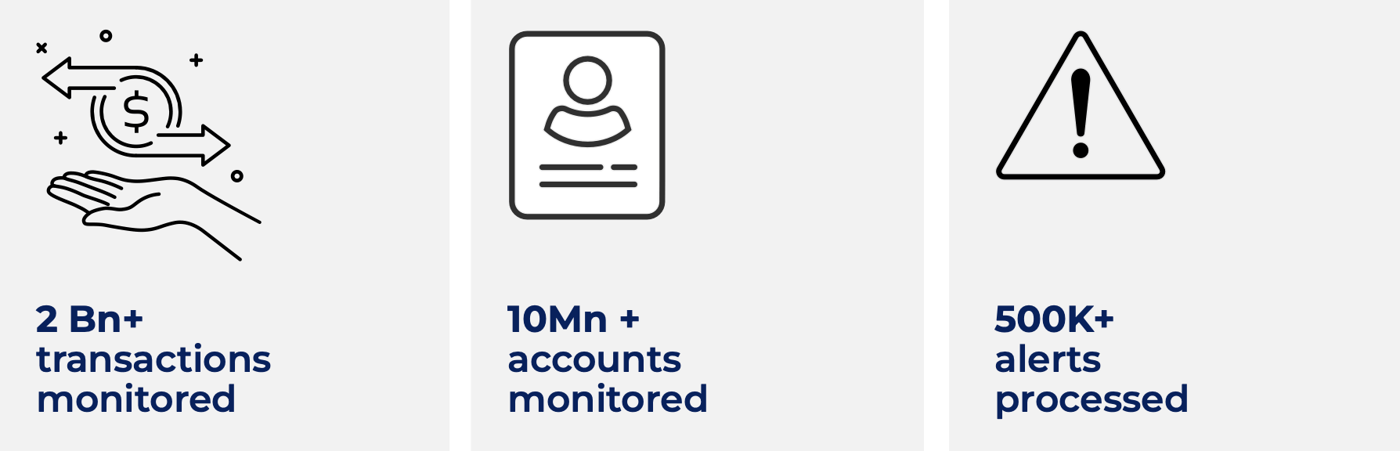

Think holistic risk coverage, sharper detection, and significant effort reduction in managing false alerts

The Anti-Money Laundering Suite (AMLS)

Protect your customers throughout the entire onboarding and off-boarding journey through two modules, customised to suit your needs.

Intelligent Alert Detection (IAD) for detection and prevention and Smart Alert Management (SAM) for management.

SAM for Better ROI for Banks

Complement existing systems by cutting through the noise and clutter generated by large volumes of alerts in legacy transaction monitoring processes.

IAD for Faster Detection for Fast-Scaling Fintechs

Ensure compliance at each step of the onboarding process powered by a library of typologies that allows you to stay up to date with regulatory requirements.